types of tax in malaysia

Income tax comparably low and many taxes which are raised in other countries do not exist in Malaysia. Malaysia is a very tax friendly country.

Steps To Change Partnership To Sole Proprietorship Company In Malaysia Tetra Consultants

When purchasing a property stamp duty must be paid on the Memorandum of Transfer.

. 14 Income remitted from outside Malaysia. Income and other taxes. The tax incentive given under ITA is in the form of allowance in addition to the capital allowance on qualifying plant and equipment acquired by the company during the ITA.

Interest paid by approved financial institutions. There are 5 different property taxes in Malaysia. Basically homeowners will now just pay the tax for their own parcel their own unit.

The Most Important Types of Insurance Aug 24 2021 The Ways to Manage Financial Risk Aug 19 2021. Special classes of income. SPA Stamp Duty Memorandum of Transfer aka MOT Loan Agreement Stamp Duty Cukai Taksiran Cukai Tanah and Real.

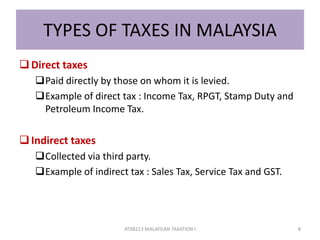

Malaysias taxes are assessed on a current year basis and are under the self-assessment system for all taxpayers. There are two types of taxes. Malaysia is one of the countries who implements territorial tax system - basically any income accrued in or derived within Malaysia is liable to tax.

Contract payments to NR contractors. There are different types of tax incentives offered in Malaysia in the form of tax exemptions allowances related to capital expenditure and enhanced tax deductions. This section explains the payment types their definition and withholding tax applied.

A specific Sales Tax rate eg. Income tax Malaysia starting from Year of Assessment 2004 tax filed in 2005 income derived from outside Malaysia and. In Malaysia indirect taxes include sales tax service tax import duty special area license manufacturing warehouse free zone free trade and exemptions.

Resident company with a paid-up capital of RM 25 million or less and gross income from business of not more than RM 50 million. For the first RM 100000 stamp duty is one percent. Cukai taksiran is a much more familiar term for this type of tax.

Any work or professional service performed or. Youll be taxed if you gain profit from renting a house land vehicle or even goods used by someone where you receive money in return. Type of company.

Stamp duty is based on the purchase price. There are exemptions from Sales Tax for certain persons eg. Contract payment for services done in Malaysia.

Heres an overview of the type. Sales tax in Malaysia are from 5 to 10 this mostly apply to those are in food business. In Malaysia the most major direct tax is income tax.

Excise duty is a type of tax. Double Taxation Agreements - if an expat is a tax resident of two different countries they may have to. 030 Malaysian ringgits MYR per litre is applicable to petroleum products.

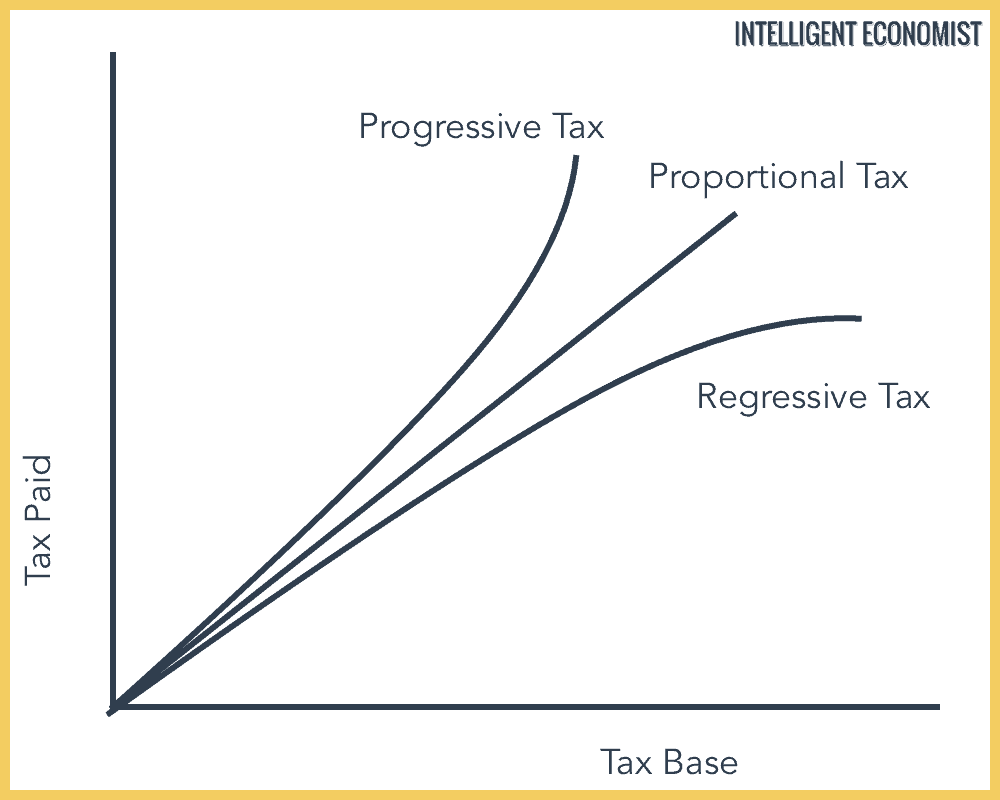

Types Of Taxes Intelligent Economist

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Pdf Tax And Revenue Trends And Implications In Malaysia

Malaysia Avoiding Rental Pitfalls Asean Economic Community Strategy Center

Overview Of Malaysian Taxation By Associate Professor Dr Gholamreza Zandi Ppt Download

Tax Types Of Tax Direct Indirect Taxation In India

What Are The Sources Of Revenue For Local Governments Tax Policy Center

Malaysia Sst Sales And Service Tax A Complete Guide

Malaysia Free Trade Zones All You Need To Know Tetra Consultants

Malaysia Personal Income Tax Guide 2020 Ya 2019

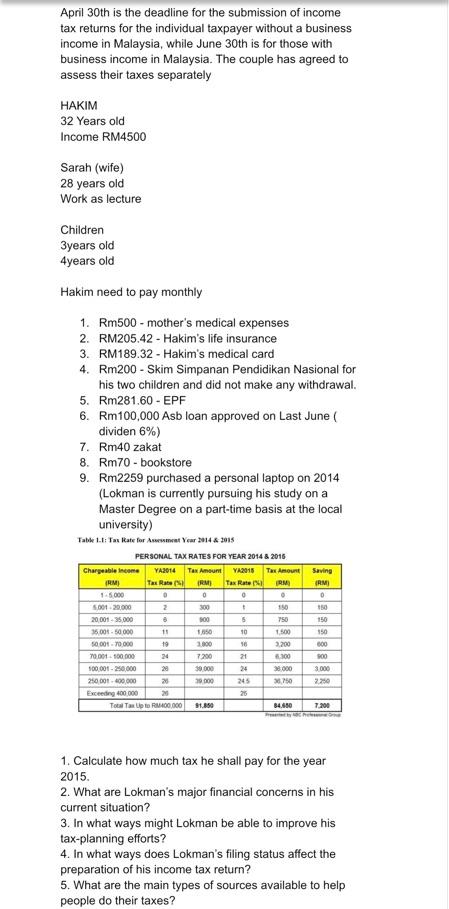

April 30th Is The Deadline For The Submission Of Chegg Com

Types Of Taxes Intelligent Economist

Business Income Tax Malaysia Deadlines For 2021

How Does The Current System Of International Taxation Work Tax Policy Center

Comments

Post a Comment